Last Minute Tax Filing Tips

The deadline for filing a 2019 tax return is this Wednesday, July 15. Here are some last-minute tips to make this week easier: Electronic filing is the best optionTaxpayers who…

Follow-Up on Tennessee Business Relief Program Instructions

[Note that this program is limited to smaller taxpayers and to businesses only in certain sectors. Although we are working hard to identify and help our clients who are eligible…

Education Credits

With schools hopefully resuming this fall, parents and students should look into tax credits that can help with the cost of higher education. Credits reduce the amount of tax someone…

Keep Economic Impact Payment Notice with Other Tax Records

People who receive an Economic Impact Payment this year should keep Notice 1444, Your Economic Impact Payment, with their tax records. This notice provides information about the amount of their…

Home Office Deduction

Taxpayers who use their home for business may be eligible to claim a home office deduction. It allows qualifying taxpayers to deduct certain home expenses on their tax return. This…

Rollover relief for required minimum distributions from retirement accounts that were waived under the CARES Act

The IRS recently announced that anyone who already took a required minimum distribution (RMD) in 2020 from certain retirement accounts now can roll those funds back into a retirement account…

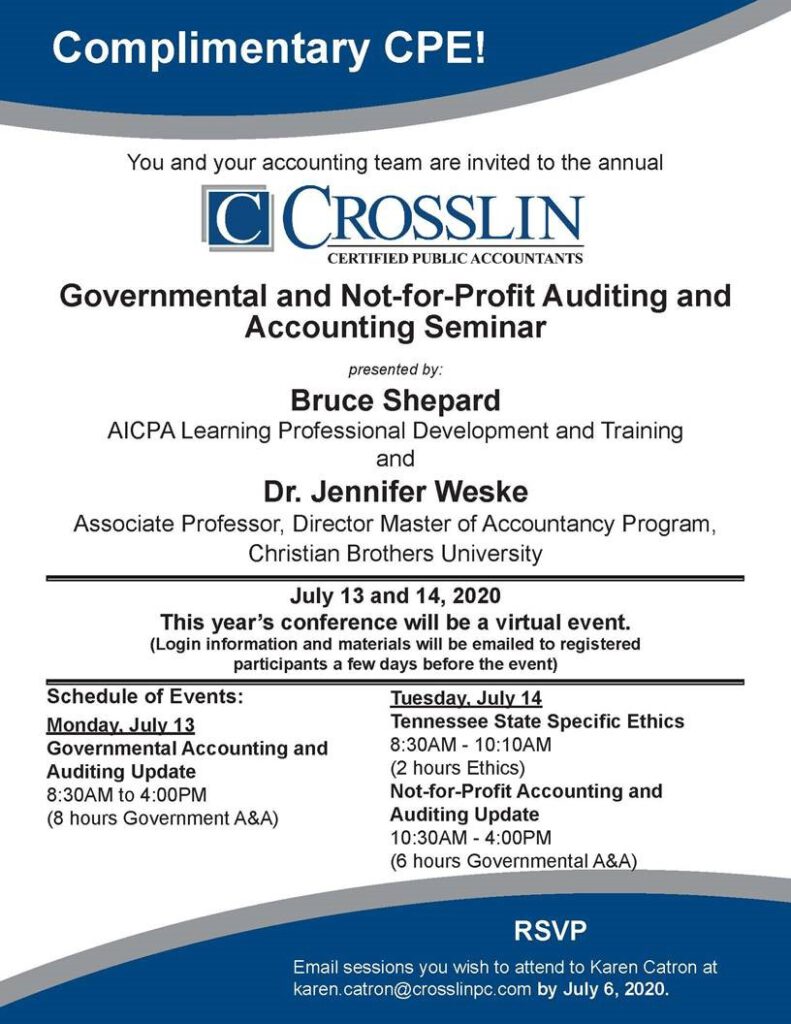

Governmental and Not-for-Profit Auditing and Accounting Seminar / CPE

2020 Tax Planning: Retirement Savings for Individuals

Now is a good time to review and evaluate your retirement savings. The tax code provides significant incentives for individuals to make contributions to retirement savings and plans, including traditional…

Deadlines Postponed Due to COVID-19

The IRS is postponing deadlines for certain time-sensitive actions due to the Coronavirus Disease 2019 (COVID-19) emergency. This relief affects: employment taxes; certified professional employer organizations (CPEOs); employee benefit plans;…

Paycheck Protection Program Forgiveness Services