Crosslin Hires Director of Accounting and Business Solutions

Mark Myers has joined Crosslin as director of accounting and business solutions, bringing more than 36 years of accounting and financial experience to the position. He will lead Crosslin’s rapidly…

What to Gather for Tax Return?

Now that the new year has begun, what information should you be gathering to file your tax return? Tax Principal Kevin Hickman and Tax Senior David Middlebrook answer your pressing…

Crosslin Announces 30th Anniversary and Leadership Changes

Regional accounting, technology, and consulting firm Crosslin is celebrating its 30th year of business this year and kicked off the anniversary with a companywide celebration with its team members. Established…

Changes in Late IRA Distributions

Unlike the baby boomer generation, most employees no longer stay with one employer for their entire career. Also, less and less employers are offering pensions—instead preferring 401k plans and other…

Government Imposter Scheme

The Tennessee Secretary of State’s office has recently made the public aware of a lawsuit it filed based on a government imposter scheme. These scams pop up every few years…

Tax Tips November 2016

Useful tax information and a little holiday cheer from the Crosslin Tax Team! View November’s Tax Tips here.

Refinancing – A Great Source for Cash

Sometimes, it can be difficult getting a loan. You need collateral, accurate, current financials, as well as a good relationship with your lender. After you get the loan, it may…

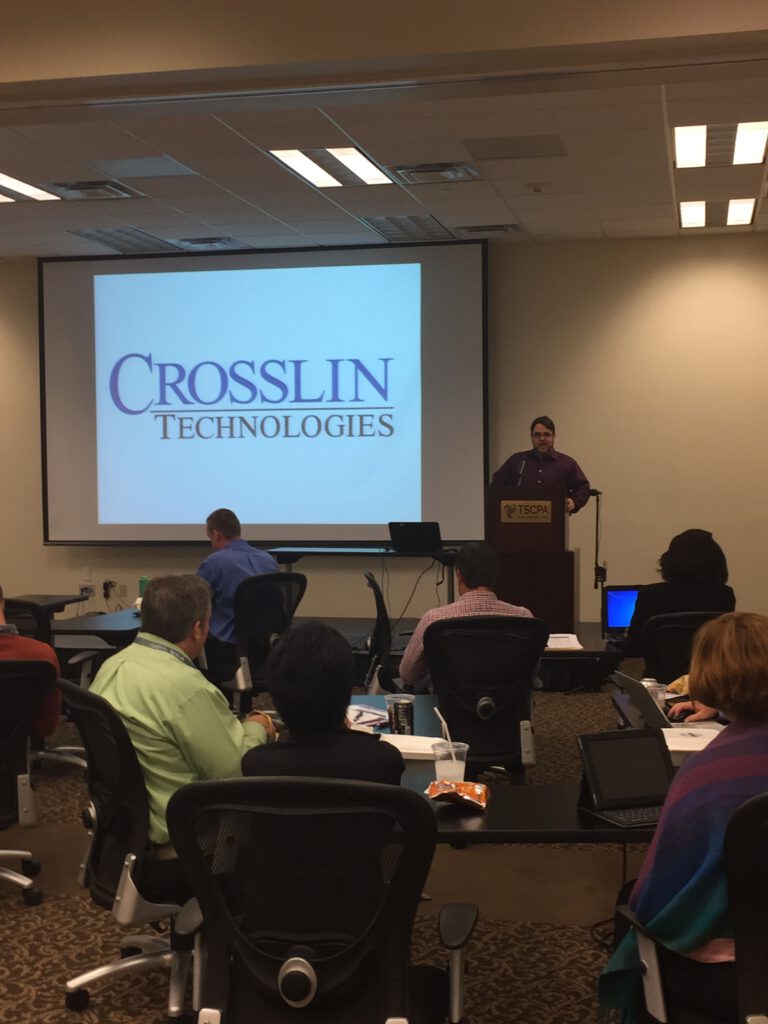

Clancy Speaks at Cyber Security Summit

Crosslin Technologies was proud to be a part of yesterday’s TSCPA (Tennessee Society of Certified Public Accountants) Cyber Security Summit. Our own Shane Clancy was a guest speaker. Thanks, TSCPA!

What are the benefits of home ownership?

In today’s Tax Tips, Tax Advanced Team Member Christina Manis and Tax Principal Kevin Hickman answer the question, “What are the benefits of home ownership?” Click here for video. Transcript:…