4 essential tax tips for new parents

As a new parent, sleepless nights aren’t the only thing that can be overwhelming. Taxes are probably last on your list of worries. However, parents are offered valuable tax breaks…

Year-End Tax Planning Guide for Businesses

Businesses of all sizes, across all industries, have been impacted by the monumental changes to the federal tax code. To maximize tax savings and ensure compliance with the new rules,…

Year-End Tax Planning Guide for Individuals

Nearly one year later, tax reform is still making headlines and we continue to learn more about its broad implications. Whether your previous tax filing posture was straightforward or complex,…

Tax Team VITA Presentation

The Crosslin tax team had a great time presenting recently at the United Way’s Volunteer Income Tax Assistance (VITA) site coordinators’ meeting. Attendees came from all over the state to…

Crosslin Adds Two Principals

Crosslin has added two longtime Nashville business leaders as principals in fast-growing areas within the company. Ward Chaffin joins as principal of the company’s accounting and business solutions (ABS) group…

U.S. Supreme Court Opens Door for Online Sales Tax

In a 5-4 decision, the U.S. Supreme Court yesterday overturned decades of legal precedent and opened the door for states to require online retailers (even with no physical presence within…

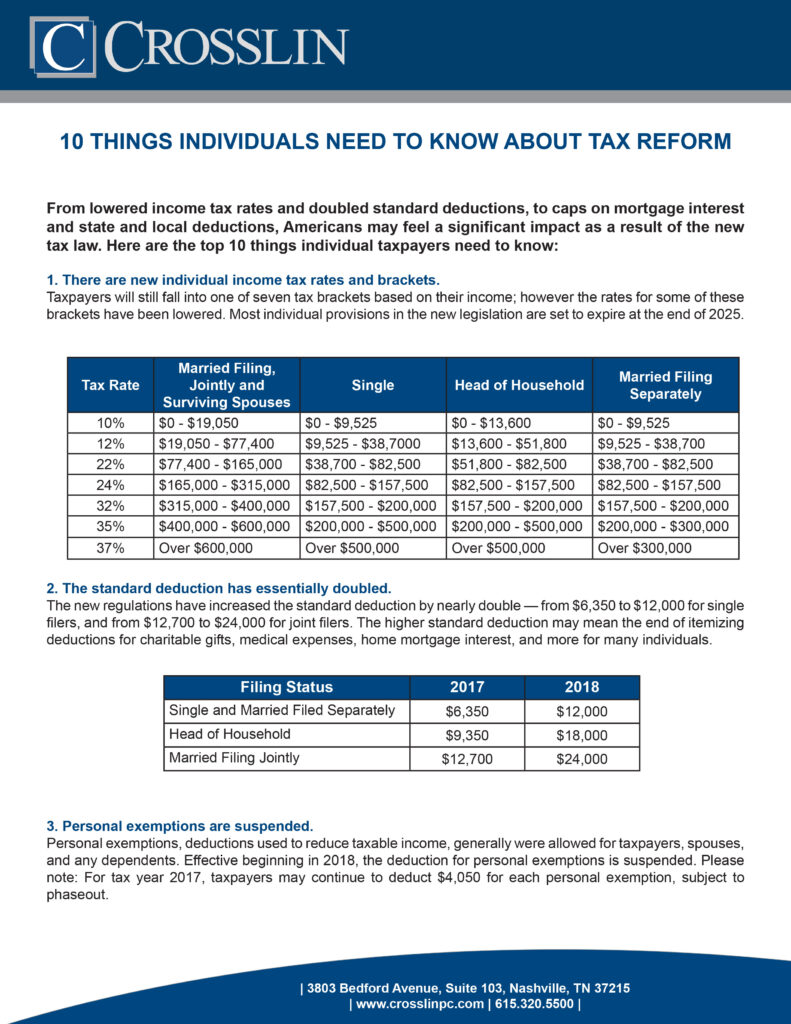

10 Things Individuals Need to Know About Tax Reform

From lowered income tax rates and doubled standard deductions, to caps on mortgage interest and state and local deductions, Americans may feel a significant impact as a result of the…

Crosslin Hosting Lunch n’ Learn

Free lunch – June 27! Join Crosslin and Carter Shelton for a complimentary lunch n’ learn. We will have an in-depth Tennessee state and local tax overview, including a discussion…

Tennessee Tax Update May 2018

With the implementation of the Tennessee’s online tax system and recent legislative highlights, Crosslin’s State and Local Tax (SALT) department wanted to provide a tax update regarding these changes. The…

Tax reform planning checklist for businesses

As the biggest change to the tax code in a generation, the new tax regime will have broad implications on both businesses and the people behind them. But what does…