Key Business Tax Breaks

Crosslin wanted to keep these updates and opportunities available to you top of mind as we enter tax season. Below are the key business tax breaks under the One Big…

Crosslin to Relocate Its Nashville Office

Crosslin is excited to announce a Nashville office relocation to our recently purchased building at 107 Kenner Avenue, near the popular intersection of Harding and White Bridge Roads. Our Nashville…

Bank of America accounts require an update in QuickBooks Online

Bank of America is updating bank account connections in QuickBooks Online. All current QuickBooks Online clients with an active Bank of America connection must update their connection in QuickBooks to…

Crosslin’s New Nashville Office Location

Exciting news! The Nashville office of Crosslin will be changing locations before the end of the year. The company has purchased a building located at 107 Kenner Avenue, Nashville 37205. …

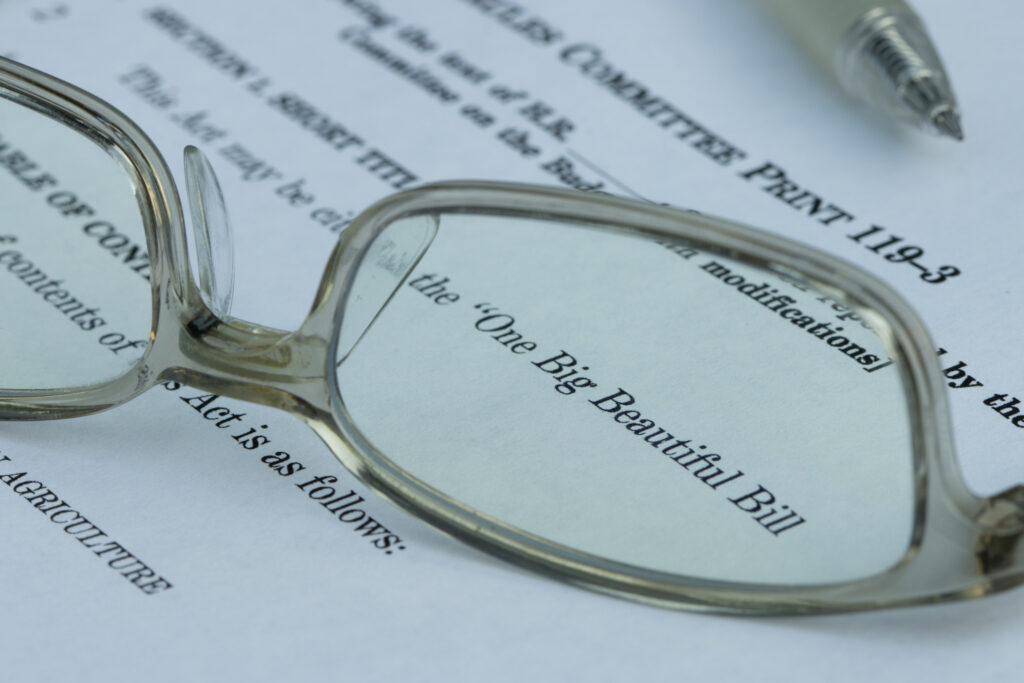

Republicans Complete Sweeping Reconciliation Bill

The president signed into law a sweeping reconciliation tax bill in a July 4 signing ceremony, capping a furious sprint to finish the legislation before the self-imposed holiday deadline. The…

Beware of Common Tax Scams

Scammers work hard to try to steal money and personal information during tax season and all year long. It is important to remain alert and aware of these common scams to…

Check Withholding Now to Prepare for Next Year

Proper tax withholding now is key to avoiding surprises when you file next year. Making any needed adjustments early means you won’t have to make a big change later in…

Governor’s Early Literacy Foundation’s Literacy Alliance Dinner

Crosslin team members enjoyed attending the Governor’s Early Literacy Foundation’s Literacy Alliance Dinner recently at the Tennessee State Museum. Great event!

TN and KY Tax Deadlines Moved to Nov. 3

The Internal Revenue Service announced tax relief for all individuals and businesses in the states of Tennessee and Kentucky affected by severe storms, straight-line winds, tornadoes and flooding. All taxpayers…

BOI Reporting – Requirement Removed

The Financial Crimes Enforcement Network (FinCEN) recently removed the requirement for U.S. companies and U.S. persons to report beneficial ownership information (BOI) to FinCEN under the Corporate Transparency Act. All…