Special Rules for Use of Retirement Funds

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides relief designed to increase liquidity in the economy including modifications to the rules on the use and distribution of retirement…

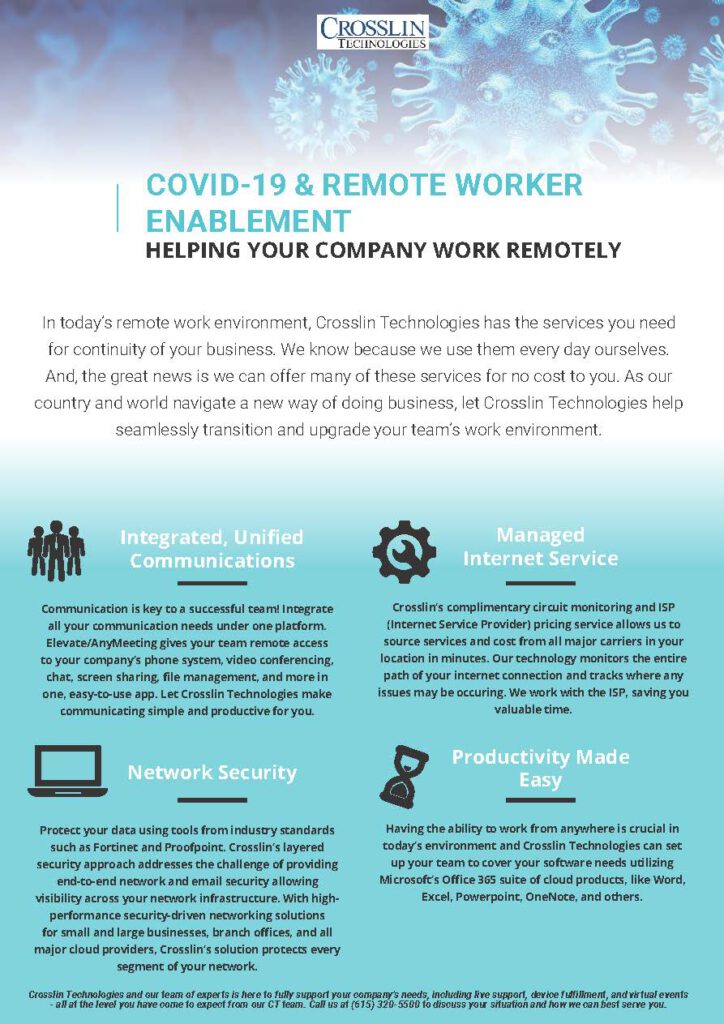

Helping Your Company Work Remotely

Loans Available for Businesses

Crosslin has received numerous follow-up questions regarding loans available for businesses. The Paycheck Protection Program (“PPP”) authorizes up to $349 billion in forgivable loans to small businesses to pay their…

CARES ACT SUMMARY

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief and Economic Security (CARES) Act, which provides relief to taxpayers affected by the novel coronavirus (COVID-19). The…

SBA DISASTER ASSISTANCE IN RESPONSE TO THE CORONAVIRUS – LOW-INTEREST LOANS

In response to the novel coronavirus (COVID-19) pandemic affecting the small business community across the country, the U.S. Small Business Administration (SBA) is offering low-interest federal disaster loans for working…

IRS OUTLINES PROCEDURES FOR PAYROLL TAX CREDITS AND RAPID REFUNDS FOR EMPLOYERS MAKING FEDERALLY-MANDATED COVID-19 LEAVE PAYMENTS

The federal government is trying to get much-needed cash into the hands of employers and employees affected by COVID-19 as quickly as possible. To do so, it is utilizing employers’ existing…

Retirement Savings for the Self-Employed

Many tax-favored options are available to self-employed individuals to provide for their retirement. Tax planning for retirement can include deductible contributions to a traditional or Roth IRA, SEP plan, SIMPLE…

Tax Deadline Extended / Tips on Submitting Tax Information

This has certainly been a challenging tax season for many reasons. The Crosslin tax team is currently working remotely to make sure that all of our client deadline needs are…

Summary of Tax Deadline Changes

With the influx of news and uncertainty over the last few weeks due to both the Middle Tennessee tornado and coronavirus, we wanted to summarize the changes that the IRS…

The Families First Coronavirus Response Act – What It Means for Employers

The Families First Coronavirus Response Act (H.R. 6201), became law on March 18, 2020. The Act guarantees free testing for the novel coronavirus (COVID-19), establishes emergency paid sick leave, expands…