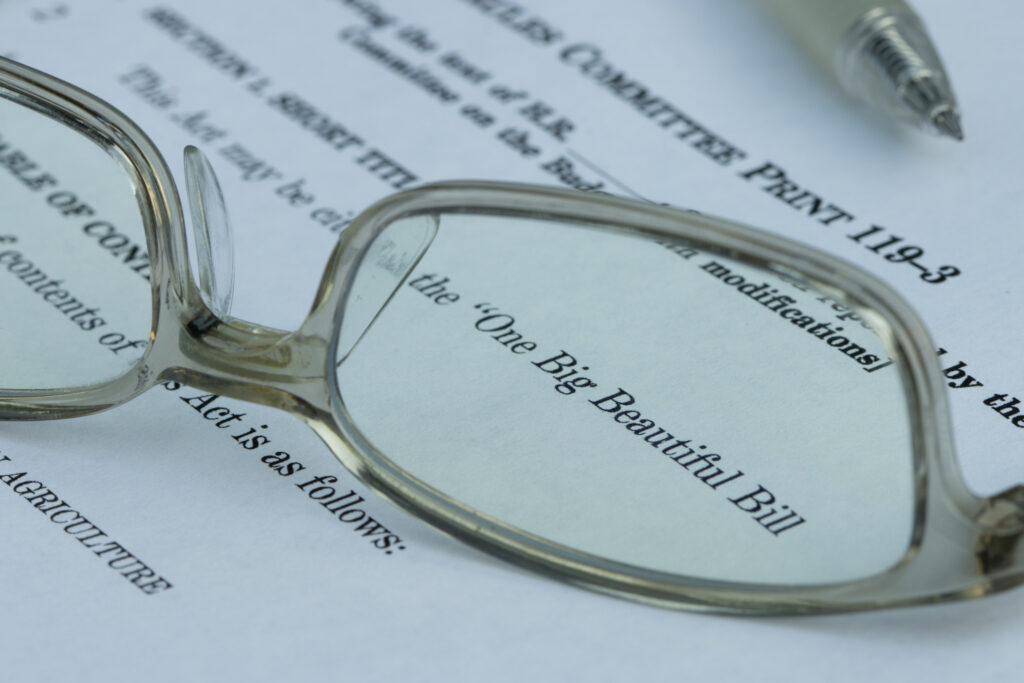

Republicans Complete Sweeping Reconciliation Bill

The president signed into law a sweeping reconciliation tax bill in a July 4 signing ceremony, capping a furious sprint to finish the legislation before the self-imposed holiday deadline. The…

Beware of Common Tax Scams

Scammers work hard to try to steal money and personal information during tax season and all year long. It is important to remain alert and aware of these common scams to…

Check Withholding Now to Prepare for Next Year

Proper tax withholding now is key to avoiding surprises when you file next year. Making any needed adjustments early means you won’t have to make a big change later in…

Governor’s Early Literacy Foundation’s Literacy Alliance Dinner

Crosslin team members enjoyed attending the Governor’s Early Literacy Foundation’s Literacy Alliance Dinner recently at the Tennessee State Museum. Great event!

TN and KY Tax Deadlines Moved to Nov. 3

The Internal Revenue Service announced tax relief for all individuals and businesses in the states of Tennessee and Kentucky affected by severe storms, straight-line winds, tornadoes and flooding. All taxpayers…

BOI Reporting – Requirement Removed

The Financial Crimes Enforcement Network (FinCEN) recently removed the requirement for U.S. companies and U.S. persons to report beneficial ownership information (BOI) to FinCEN under the Corporate Transparency Act. All…

BOI Update: Enforcement Penalties on Hold

As the saga continues, the latest update on federal Beneficial Ownership Information (BOI) reporting requirements indicates that FinCEN will not issue any fines or penalties or take any other enforcement actions against any…

Educator expense deduction can help offset out-of-pocket classroom costs

The educator expense deduction lets eligible teachers and administrators deduct part of the cost of technology, supplies and training from their taxes. According to the IRS, they can claim this…

Newlyweds Tax Checklist

Summer wedding season has arrived, and newlyweds can make their tax filing easier by doing a few things now. A taxpayer’s marital status as of December 31 determines their tax…

Crosslin Promotes Payne to Principal

Crosslin has promoted Curtis Payne to principal in the audit department. In this role, he will assume a broader responsibility in leading the Crosslin audit team and focus on increased…