Three Named to the NBJ’s Power Leaders of Finance List

Congratulations to Dell, John, and Justin for being named to this year’s Nashville Business Journal Power Leaders of Finance list! We appreciate their leadership and it’s nice to see it…

U.S. Supreme Court Opens Door for Online Sales Tax

In a 5-4 decision, the U.S. Supreme Court yesterday overturned decades of legal precedent and opened the door for states to require online retailers (even with no physical presence within…

Crosslin Adds Team Members

Crosslin has expanded its accounting and business solutions and audit teams. The accounting and business solutions (ABS) department welcomes Rise’ Holt as an ABS team member. Holt brings more than…

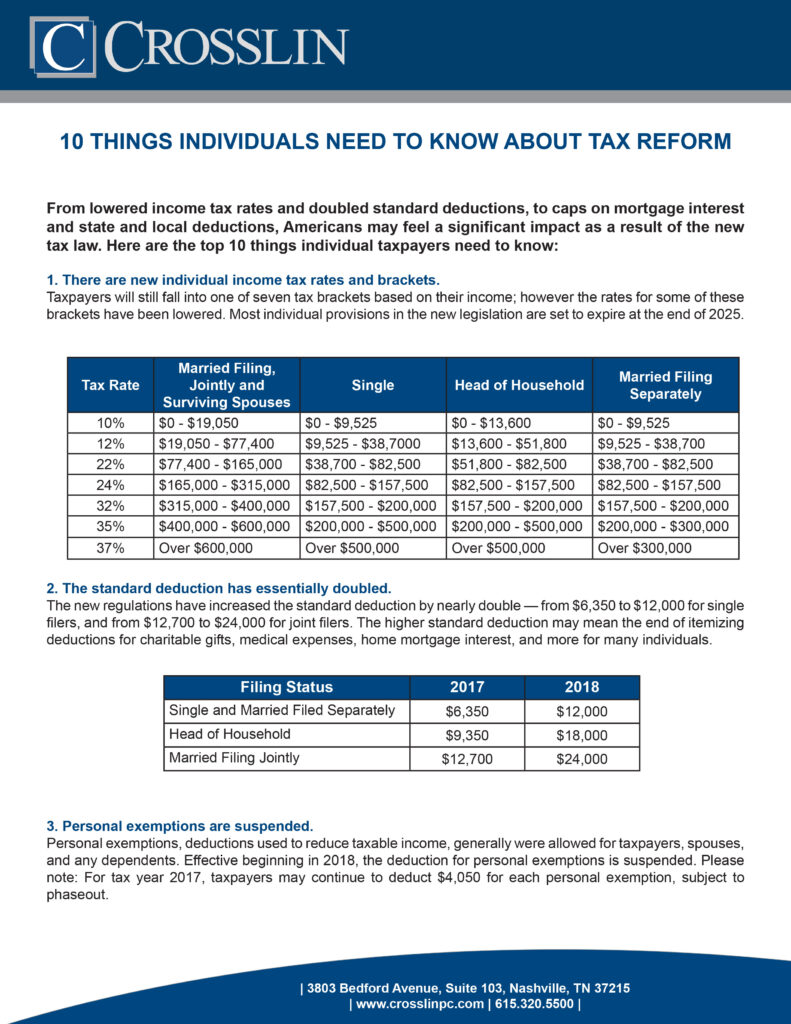

10 Things Individuals Need to Know About Tax Reform

From lowered income tax rates and doubled standard deductions, to caps on mortgage interest and state and local deductions, Americans may feel a significant impact as a result of the…

Crosslin Technologies Named Small Business of the Year

Hooray, CT! Crosslin Technologies has been named a Small Business Award honoree by the Nashville Business Journal. This awards competition recognizes the companies in Music City who may be small…

Crosslin Hosting Lunch n’ Learn

Free lunch – June 27! Join Crosslin and Carter Shelton for a complimentary lunch n’ learn. We will have an in-depth Tennessee state and local tax overview, including a discussion…

Hagerman Promoted to Marketing Director

Crosslin has promoted Emily Hagerman to marketing director. She most recently served as marketing coordinator for Crosslin. In this role, she was responsible for creating marketing collateral, drafting new business…

Tennessee Tax Update May 2018

With the implementation of the Tennessee’s online tax system and recent legislative highlights, Crosslin’s State and Local Tax (SALT) department wanted to provide a tax update regarding these changes. The…

Best Places to Work Video – Crosslin Technologies

Crosslin Technologies was recently named a finalist in the Nashville Business Journal’s Best Places to Work award competition. As a finalist, we were asked to put together a fun video…

Crosslin Technologies Named Best Places to Work Winner

Crosslin Technologies was named a winner in the 2018 Best Places to Work Awards today, sponsored by the Nashville Business Journal. Companies are selected for displaying a strong commitment to…