Year-End Tax Planning Guide for Businesses

Businesses of all sizes, across all industries, have been impacted by the monumental changes to the federal tax code. To maximize tax savings and ensure compliance with the new rules,…

Year-End Tax Planning Guide for Individuals

Nearly one year later, tax reform is still making headlines and we continue to learn more about its broad implications. Whether your previous tax filing posture was straightforward or complex,…

Nonprofit Standard Summer/Fall 2018

Crosslin recently released Nonprofit Standards, its quarterly newsletter that addresses accounting issues that affect today’s nonprofits. Topics in this issue include: Six tax reform issues impacting nonprofit organizations Is your…

Three Named to the NBJ’s Power Leaders of Finance List

Congratulations to Dell, John, and Justin for being named to this year’s Nashville Business Journal Power Leaders of Finance list! We appreciate their leadership and it’s nice to see it…

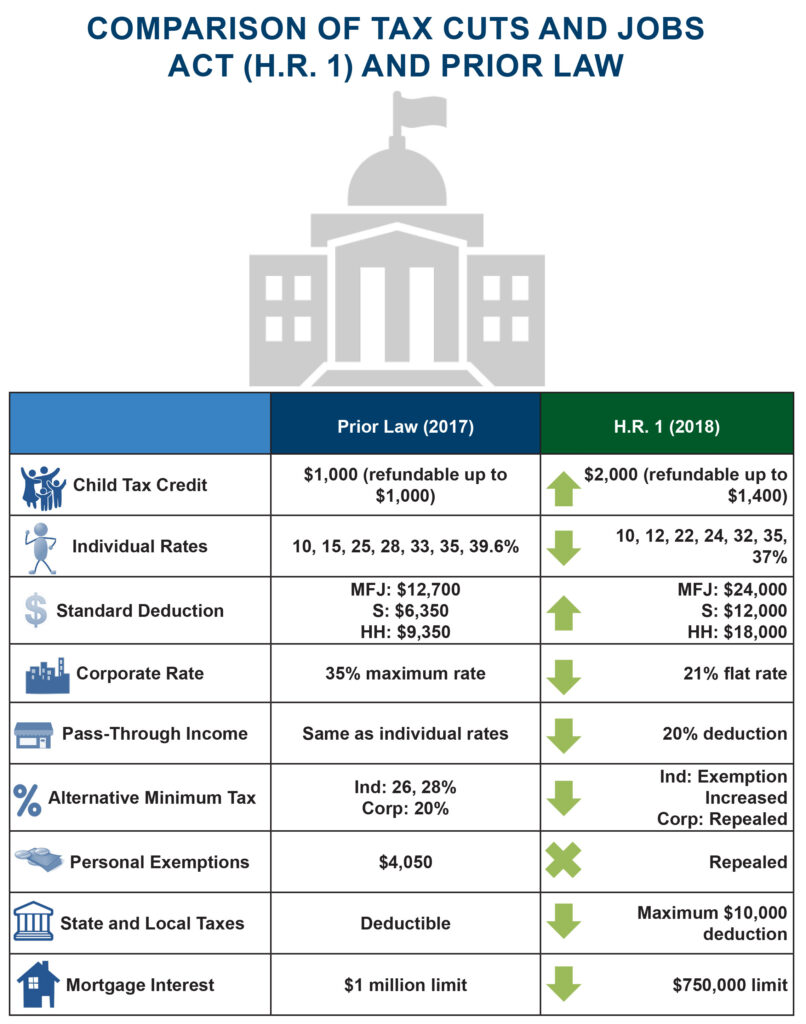

Tax Cuts and Jobs Act Summary

The Tax Cuts and Jobs Act, which Congress recently passed, amends the Internal Revenue Code to reduce tax rates and modify policies, credits, and deductions for individuals and businesses. President…

Tax Booklet Available

Crosslin has released its 2017 Year-End Tax Planning Booklet. Please review and call the Crosslin tax team with any questions as we beginning to work on your 2017 taxes. We…

4 actions that could trigger a state and local tax audit

Check out our very own Mark Loftis, Director of State and Local Tax, in today’s Nashville Business Journal. Very informative! Article can be found here.

Crosslin Best in Business Video

Check out the Crosslin video from this week’s Best in Business Awards.

Crosslin Named Finalist in Best in Business

Crosslin was today named a finalist in the 2017 Best in Business Awards, sponsored by the Nashville Business Journal. Companies are judged on service, growth, innovation, and strategy. We are…

Upcoming Financial Reporting Changes for Not-for-Profit Organizations

The Financial Accounting Standards Board (“FASB”) has issued FASB Accounting Standards Update (“ASU”) No. 2016-14, Not-for-Profit Entities (Topic 958): Presentation of Financial Statements of Not-for-Profit Entities, which is an accounting…