Taxpayers with expiring Individual Taxpayer Identification Numbers (ITINs) can get their ITINs renewed more quickly and avoid refund delays next year by submitting their renewal application soon.

An ITIN is a tax ID number used by taxpayers who don’t qualify to get a Social Security number. Any ITIN with middle digits 83, 84, 85, 86 or 87 will expire at the end of this year. In addition, any ITIN not used on a tax return in the past three years will expire.

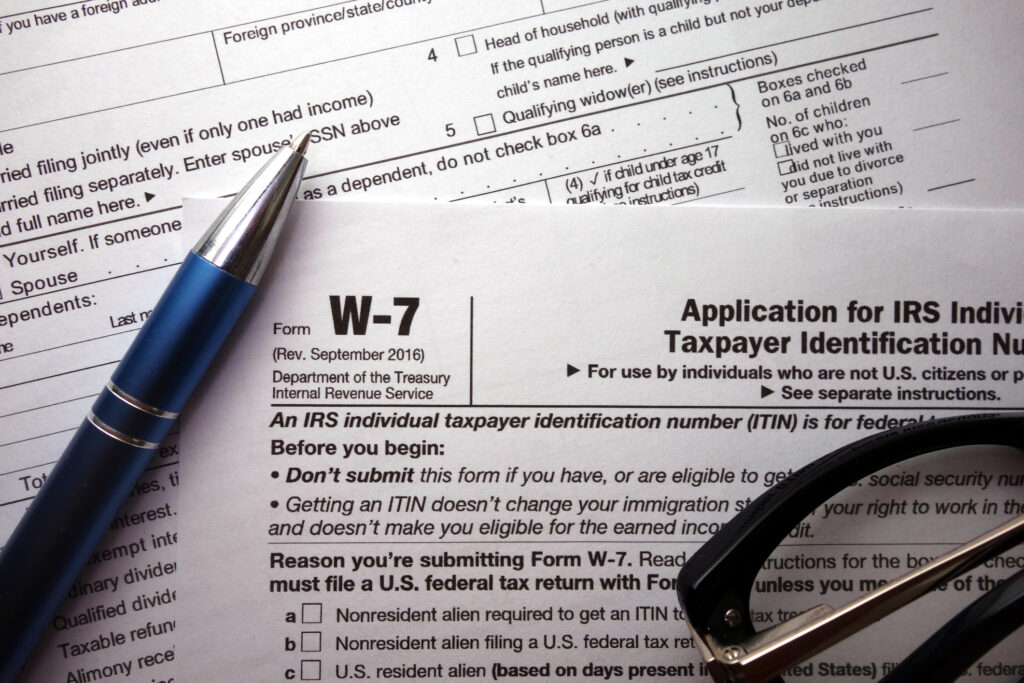

The Internal Revenue Service encourages anyone affected to file a complete renewal application, Form W-7, Application for IRS Individual Taxpayer Identification Number, as soon as possible.

Please contact the Crosslin tax team today for help renewing employee ITINs. By doing so now, we can help you avoid any delays. We appreciate your business!