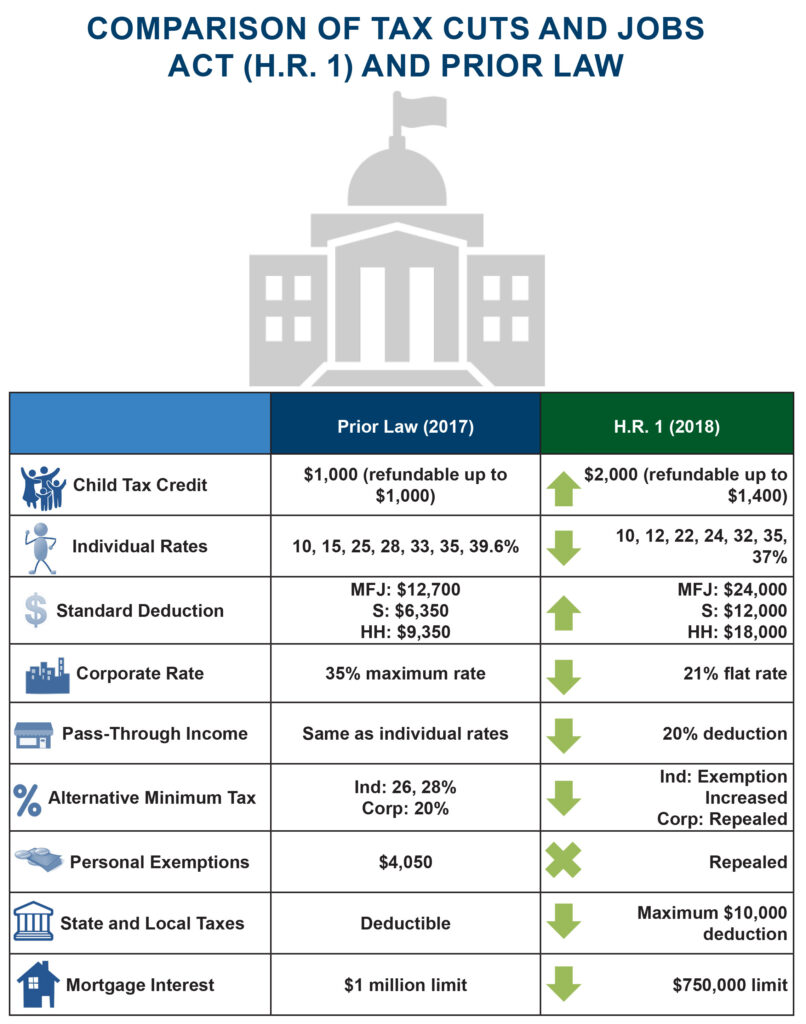

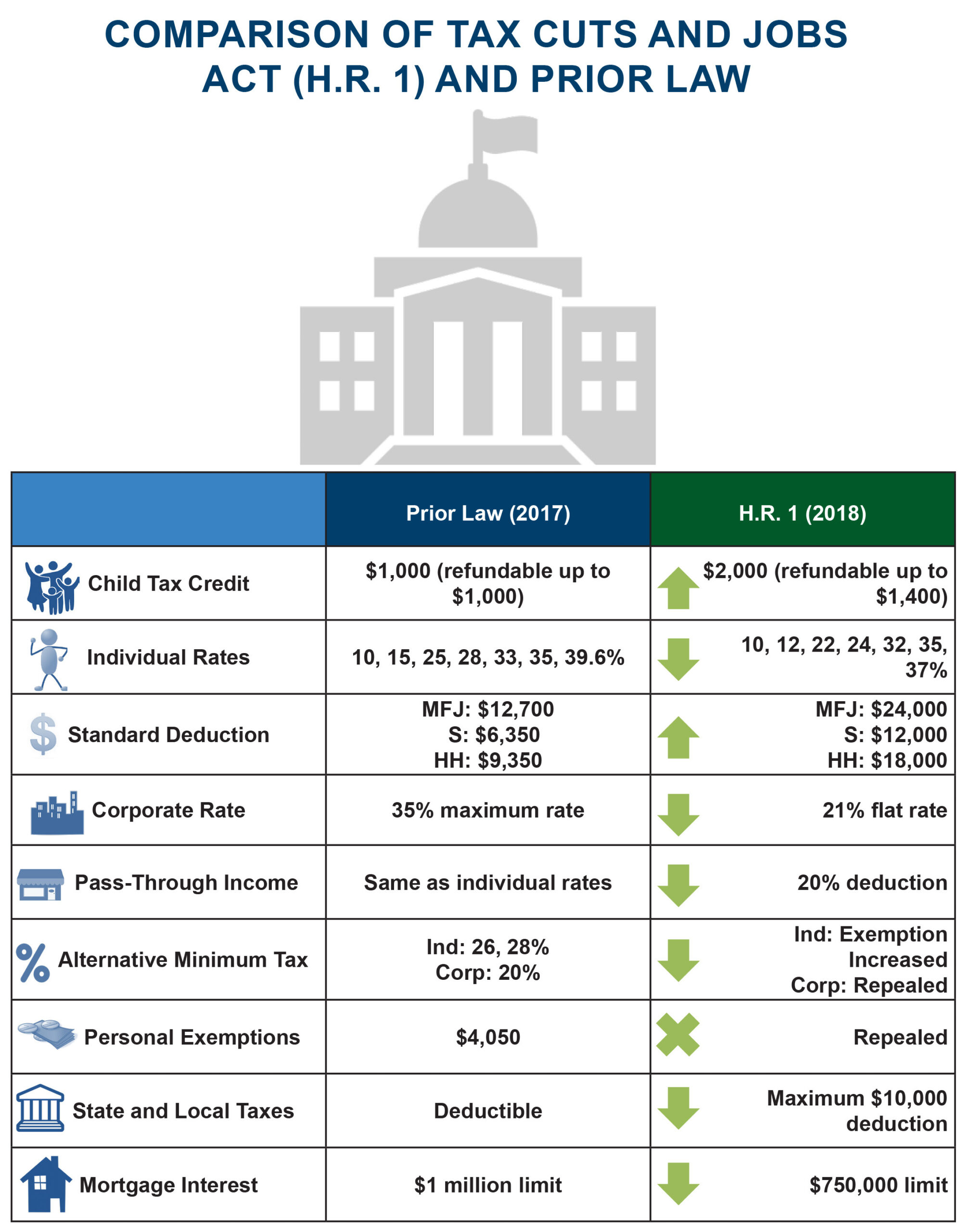

The Tax Cuts and Jobs Act, which Congress recently passed, amends the Internal Revenue Code to reduce tax rates and modify policies, credits, and deductions for individuals and businesses. President Trump signed the bill into law on Friday, December 22, 2017. Most of the law’s provisions take effect in 2018. Read below about some of the provisions and how they may affect you.

With respect to individuals, the bill:

- revises the seven existing tax brackets (10%, 15%, 25%, 28%, 33%, 35%, and 39.6%) with new tax rates (10%, 12%, 22%, 24%, 32%, 35%, and 37%),

- increases the standard deduction to $12,000 for single filers, $18,000 for heads of households, and $24,000 for joint filers,

- repeals the deduction for personal exemptions,

- increases the child tax credit to $2,000 and establishes a new family tax credit,

- repeals the overall limitation on certain itemized deductions,

- retains the current mortgage interest deduction, but limits the mortgage interest deduction for new purchases to mortgages of up to $750,000 (currently $1 million),

- limits the deduction for state and local income or sales taxes not paid or accrued in a trade or business at $10,000,

- consolidates and repeals several education-related deductions and credits, and

- doubles the estate tax exemption.

For businesses, the bill:

- reduces the corporate tax rate from a maximum of 35% to a flat 21% rate,

- allows increased expensing of the costs of certain capital investment,

- limits the deductibility of net interest expenses to 30% of the business’s EBITDA for four years and then 30% of EBIT,

- repeals the corporate alternative minimum tax,

- modifies the taxation of foreign income, and

- moves taxation to more of a territorial system verses being taxed on worldwide income.

The Crosslin tax team is ready to assist with any questions you may have. Over the next couple weeks, our tax team will be releasing videos specifically addressing the changes to the tax code. We are gearing up for a busy tax season and look forward to serving you. As always, we appreciate your business!